Rate Quotes 101: What You Need to Know About Hidden Merchant Service Fees

Rate Quotes 101: What You Need to Know About Hidden Merchant Service Fees

Every business owner’s been there: You think you got a great rate on your online bill pay system only to be stunned by all the hidden merchant service fees in your first invoice.

It’s not uncommon for rate quotes to leave out 5 or even 10 fees that you will absolutely be responsible for paying for the duration of your (often long-term) contract. You can avoid this pitfall, however, if you know the formula to calculate your rates accurately.

Here’s how to break down merchant service fees — and what to ask when considering online payment solutions.

1. Know the most common merchant service fees

Every merchant service company has their own set of fees. As you’d expect, some have higher fees than others, and some have more fees overall.

Common fees associated with credit card transaction processing can include any or all of the following:

- Credit card rate fee

- Assessment fees

- Monthly minimum fee

- Transaction fee

- Batch settlement fee

- Statement fee

- Monthly fee

- Authorization fees

- Setup fee

- Annual fee

- Payment gateway fee

- Early termination fee

The best way to avoid being hit with these: Ask for a breakdown.

Ask a company: Can you provide me with an example of what my monthly bill will look like? Or with a sample bill from a similar company?If they can’t or won’t, you have your answer.

2. Beware of miscellaneous fees

On top of those 9 common merchant service fees, you also have to be on the lookout for the most insidious, costly line item: the miscellaneous fee. While some miscellaneous fees do go toward valid business expenses, it’s unreasonable for companies to expect you to blindly trust that unexplained fees are necessary.

Ask a company: Will I see any “miscellaneous fees” on my bill? Can you explain what each fee does?

3. Perform a merchant service fees analysis

If you already have a bill pay service, start analyzing the fees you’re currently paying. If you’re considering a new payment gateway solution, ask for their fee structure. Better yet, ask them to provide you with an analysis. You’ll need to check their work, of course, but if they’ll provide one for you, it’s a good indicator of their customer service mentality.

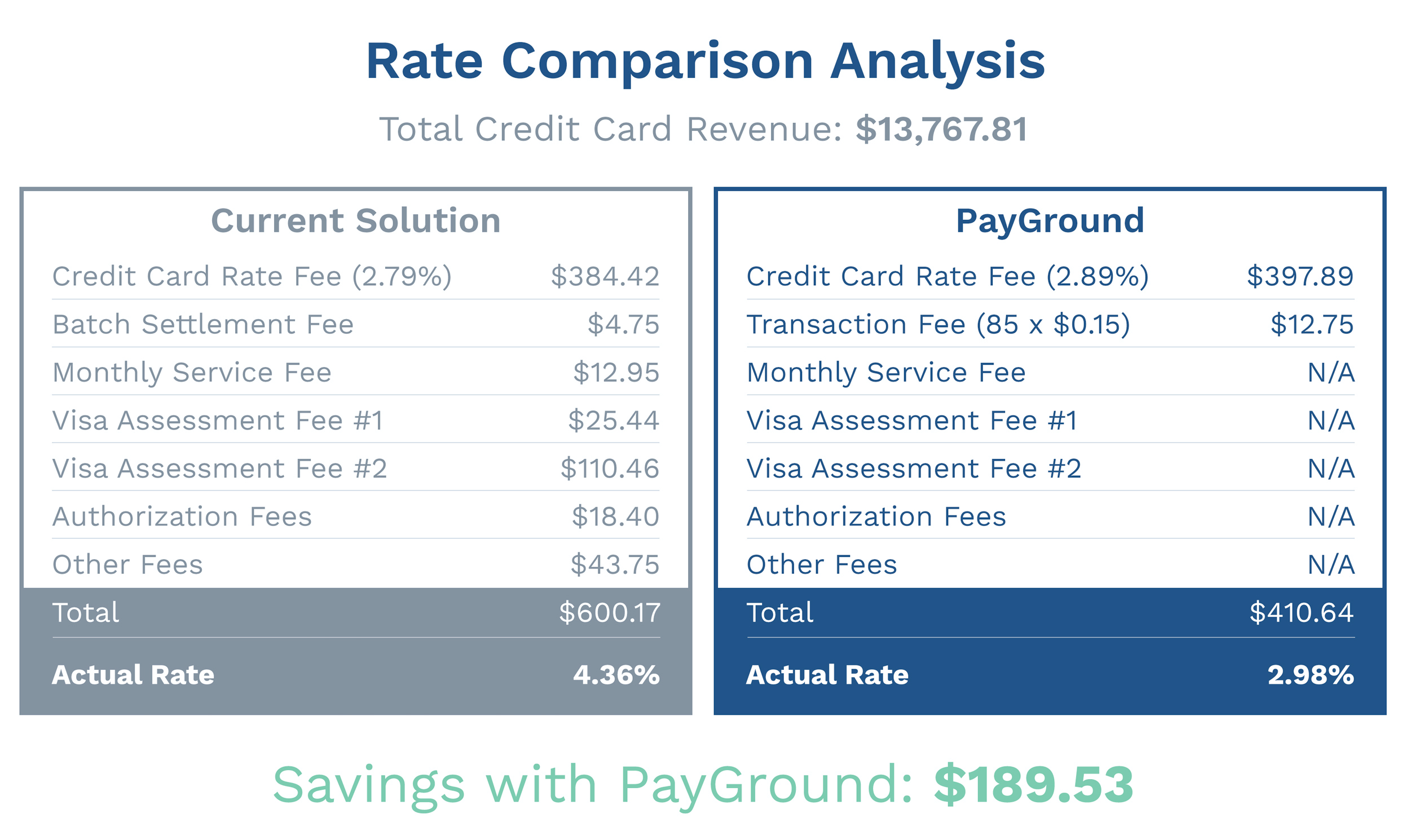

Here’s what a rate comparison analysis should look like:

Here’s how to calculate a rate comparison analysis:

To determine what percentage of your revenue a company will keep, use this formula: total fees paid ÷ total onsite credit card revenue = actual rate In the example above, you can see that:

- Company X quoted you a credit card rate fee of 2.79%.

- On its face, that sounds better than the 2.89% rate PayGround would quote you.

- HOWEVER: once you start taking into account all extra fees, your actual rate with Company X will be closer to 4.36% as opposed to our fee of 2.89% + 15 cents per credit card transaction.

You were told one thing, but when you do the math, it doesn’t add up.

How are merchant service fees different with PayGround?

We believe simpler is better. That’s why we built PayGround — so we could offer people what we always wanted: no hidden or unnecessary fees. With PayGround, we charge only 2 fees for credit card transactions:

- A credit card rate fee

- Transaction fee

If collecting payment via ACH, we don’t even charge a transaction fee.Two charges. That’s it, and that’s all.

Let’s talk specifics

Contact us now for a free rate comparison analysis.